Welcome to the comprehensive guide on acquiring Electra Coin, a dynamic player in the digital currency arena. This article delves into the nuances of Electra Coin, outlining its history, unique technical choices, and distinguishing features.

Aimed at both novices and seasoned investors, the piece provides a thorough understanding of how to navigate the Electra Coin ecosystem, ensuring readers are well-equipped to make informed decisions in this ever-evolving market.

The Evolution of Cryptocurrencies and Electra Coin’s Journey

Cryptocurrencies have transcended being mere technological novelties to become integral parts of the global financial landscape. While decentralized finance (DeFi), decentralized exchanges (DEXs), and non-fungible tokens (NFTs) dominate current discussions, it’s crucial to acknowledge the rich history of digital currencies. Among these, Electra Coin has been a notable presence.

Launched nearly five years ago, Electra Coin has adapted remarkably to the shifting digital currency environment. This adaptation is evident in its progression and the strategic pivots it has made to remain relevant and competitive.

Understanding Electra Coin

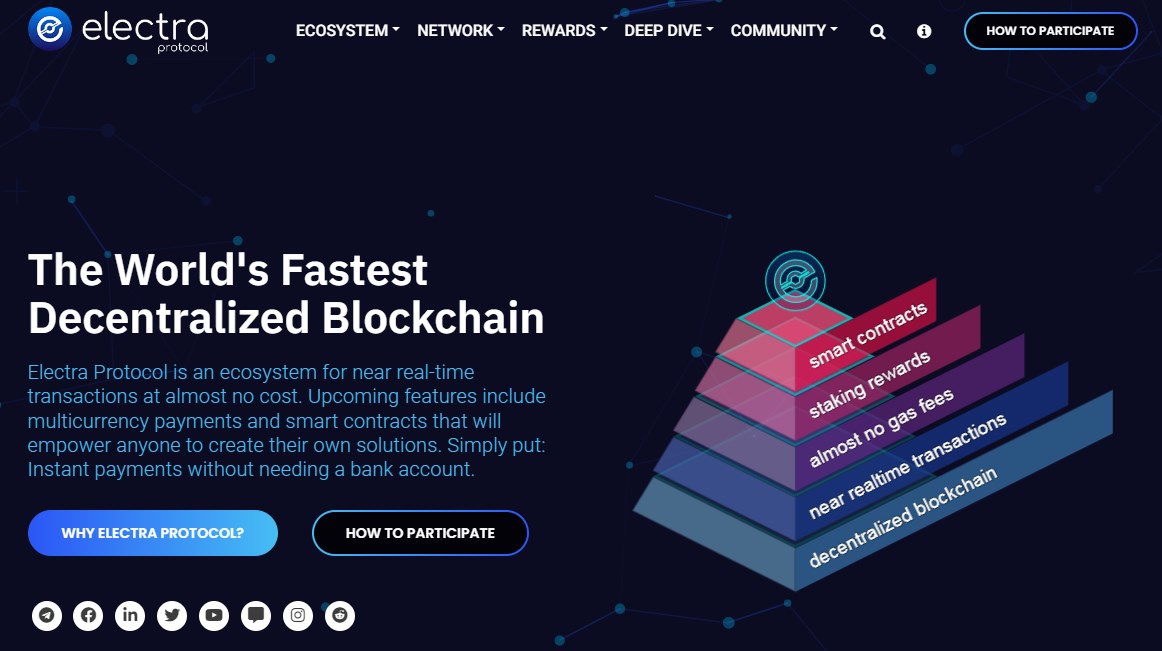

Electra Coin represents a visionary project aimed at reshaping the global payment systems. Central to its design is the Electra Coin (ECA), a digital asset purposed for a wide range of transactions. Since its inception in 2017, the project has undergone significant revisions to align with the evolving digital landscape. Its current objectives, as detailed in the latest whitepaper, encompass:

- Developing a cryptocurrency at the forefront of technological advancements;

- Establishing a dependable financial ecosystem for stakeholders;

- Upholding decentralization to ensure community involvement in future developments.

Electra Coin’s ambition extends beyond niche applications; it seeks to establish an optimal network for routine transactions, challenging established players in the sector.

Technical Innovations of Electra Coin

Electra Coin’s distinction lies in its technical framework, designed to make ECA a viable option for daily transactions. Originating as a Proof of Work network, it transitioned to Proof of Stake in 2017, reflecting a strategic shift. Key technical aspects include:

- Utilization of the NIST 5 blockchain algorithm, derived from a comprehensive study by the United States National Institute of Standards and Technology;

- A blockchain with a 64-second confirmation time and a 10 MB block size, supporting atomic swaps and the Lightning Network;

- The capability of handling approximately 1,600 transactions per second, enhanced by SegWit, with transaction costs at a negligible 0.000001 ECA.

These technical attributes are tailored to support a global payment and merchant ecosystem.

Electra Coin’s Unique Features

Electra Coin’s pursuit of becoming a global payment system is underpinned by several key initiatives and network enhancements. In 2019, a significant network fork transitioned it to Proof-of-Stake v3.0e, focusing on security and efficiency improvements. Notable features include:

- The PoSv3e staking mechanism, which incentivizes network connectivity by offering staking rewards. Transactions unspent for 12 hours become eligible for these rewards, fostering network stability;

- An environmentally conscious approach, pivoting away from traditional cryptocurrency mining;

- Enhanced network throughput, courtesy of the Lightning Network and SegWit, crucial for the development of a diverse range of products, including Electra Coin wallets, merchant applications, mobile apps, point-of-sale solutions, and centralized payment gateways.

As Electra Coin continues to evolve, a newly formed team is steering the project towards its next phase of development, focusing on innovation and market responsiveness.

Electra Coin’s Evolution and Future Direction

Electra Coin has experienced significant evolution since its inception, reflecting the dynamic nature of the digital asset landscape. Initially a Proof of Work (PoW) network, it transitioned to Proof of Stake (PoS), a move indicative of the project’s adaptability and responsiveness to technological advancements. This transition also involved multiple forks and upgrades, showcasing a commitment to continual improvement.

However, a notable shift occurred post-2020, with the project undergoing a period of uncertainty. In early 2021, Electra Coin was without a dedicated team, leading to a temporary stagnation in its development. This changed in April 2021 with the introduction of a new team, tasked with steering the project into a new era of growth.

While specific plans have yet to be fully disclosed, the focus remains on enhancing Electra Coin’s viability as a medium for everyday transactions. Competing with more recent and technologically advanced projects, Electra Coin’s future hinges on its ability to refine its technical infrastructure and market positioning.

Procuring Electra Coin: A Step-by-Step Guide

Obtaining Electra Coin involves a straightforward process, akin to acquiring other digital assets. However, the challenge lies in identifying appropriate trading platforms, as Electra Coin is not as widely available as some other assets. Currently, Electra Coin can be procured from the following exchanges:

- Crex24;

- Coinfalcon;

- STEX;

- C-Patex.

Prospective traders should note the relatively modest liquidity of Electra Coin, a factor that might influence trading strategies. Additionally, Electra Coin is accessible through Komodo Wallet, a multifunctional platform combining the features of a non-custodial wallet and a decentralized exchange. This versatility makes Komodo Wallet a preferred option for both storing and trading Electra Coin.

Electra Coin: A Path Forward

As a digital asset with a history, Electra Coin faces the challenge of competing in a market teeming with newer and more technologically advanced alternatives. Its aspiration to become a preferred asset for daily transactions necessitates significant enhancements and unique features to stand out. Currently, it occupies a middle ground, competing against more established assets.

The new team at the helm is actively exploring ways to revamp both the asset and its underlying network. By incorporating recent technological innovations, there is potential for Electra Coin to reposition itself significantly in the market. This transformation, while not guaranteed, is a possibility that could redefine the asset’s role in the digital currency ecosystem.

Electra Coin’s Market Presence and Strategy

Electra Coin’s position in the digital currency market is shaped by several key factors:

- Market Penetration: Despite being an older asset, Electra Coin needs to increase its visibility and accessibility across various exchanges to attract a broader user base;

- Technological Innovation: Staying abreast of the latest technological developments is crucial for Electra Coin to remain competitive;

- Community Engagement: Actively involving the community in development decisions could enhance trust and loyalty among users;

- Security Enhancements: Prioritizing robust security measures is essential to protect users’ assets and maintain credibility.

Navigating the Future of Digital Currencies

Electra Coin, like many digital assets, is navigating an increasingly complex and competitive landscape. As the market evolves, it becomes imperative for projects like Electra Coin to adapt and innovate. The key to success lies in understanding market trends, adopting cutting-edge technologies, and maintaining a user-centric approach.

For those interested in exploring beyond Electra Coin, our next article delves into the world of next-generation digital currencies. This guide provides valuable insights into emerging assets that are reshaping the landscape of digital finance.

Conclusion

In conclusion, Electra Coin’s journey through the digital currency landscape has been marked by significant changes and challenges. From its early days as a PoW network to its current phase of reevaluation and potential reinvention under a new team, Electra Coin exemplifies the dynamic nature of this sector.

As it strives to improve its technical infrastructure and market presence, Electra Coin stands at a pivotal juncture. Its success in becoming a widely accepted medium for daily transactions will largely depend on how it adapts to the evolving demands of the digital currency market and its ability to innovate. The future of Electra Coin, though uncertain, holds potential for transformation and growth, reflective of the ever-changing world of digital finance.